The following was written as part of a renewed sales initiative for SAFR, building upon the latest financial ledger projects.

This write-up written for IBM sales efforts, was used as the summary of Balancing Act: A Practical Approach to Business Event Based Insights, Chapter 2: The Problem and Chapter 3: The Solution.

The Problem

The recent financial crisis has exposed the systemic problem that the world’s largest financial institutions cannot adequately account for and report on liquidity, positions, currency exposure, credit, market, and interest rate risk and product, customer and organizational performance. The CFO plays a critical role in correcting this problem by leveraging the financial data they already control, as well as leveraging scale to take out cost. But even industry insiders do not realize that financial institutions suffer a unique set of domain problems when it comes to financial reporting.

Current financial reporting systems are antiquated and very inefficient. They were designed decades ago to simply track flow of capital, revenue and expenses at the company and departments levels. The lack of transparency is evident in the increasing costs of the finance function with few benefits to show for the investment. Sarbanes Oxley and other regulations have proven ineffective at getting at the root of the problem and the resulting financial meltdown regulations may well prove similarly ineffective. These pressures create diseconomies of scale which affect the largest institutions the most.

For the most part, existing systems deliver accurate results in summary, but the increase in transparency requires line of site to the underlying causes of those results. Consider if your personal bank account statement or credit card bill only presented the change in balance between periods, but provided no list of transactions. When the statement is as expected, further detail may not be needed. But when the balance is in question, your first response is ‘why’ and you immediately want to see the transaction detail. The same issues are at stake when managing the finances of the enterprise – with the associated cost and consequences considerably higher! A single instance of financial restatement has cost some organizations hundreds of millions of dollars to correct, not counting lost market valuation.

Currently 90% of the money supply in mature markets is represented by digital records of transactions and not hard currency. It’s no wonder that that the volume of electronic finance records being kept has exploded compared to when the systems were first created. Yet our approach to these demands has not been to automate the process of keeping and accessing the details of the transactions. Almost all employees in today’s financial institutions are involved in capturing and coding financial details in some way, and a large number of non-finance employees are involved in the investigative process to locate the additional detail so often required. The effort for this manual intervention is incredibly inefficient and costly.

As we see all around us, computing capacities have increased by several orders of magnitude since these finance systems were designed. However, reporting processes have grown organically as a system of transaction summaries in order to continue to bridge multiple financial systems – but have lacked a single unified approach. This has meant that for the most part the business of financial reporting has not benefited from the increase of computing capacities available today.

The Solution

A Smarter Planet is founded on financial markets that provide for greater transparency and comprehension of the financial reporting by bank and non-bank entities, allowing the markets to react to conditions in more informed, less reactionary ways. IBM has spent 25 years refining an approach to this for financial institutions. The IBM® Scalable Architecture for Financial Reporting™ (SAFR) system provides financial reporting that is built bottoms up from the individual business event transactions to provide the finest grained views imaginable.

By harnessing today’s computing power and straight through processing approach, the details behind summary data can be made available in seconds rather than days or weeks. Providing nearly instant access to the highest quality financial data at any level of granularity will eliminate the duplicative reporting systems which tend to capture and produce summaries of the same business events for many stakeholders and reporting requirements.

More importantly, it will automate the hidden work of armies of people who are required to investigate details and attempt to explain results, or attempt to reconcile the disparate result of these many reporting systems—a truly wasteful activity caused by the systems themselves. Keeping the details in a finance system that can serve these needs allows for increased control, quality and integrity of audit efforts rather than dissipating them.

Some may question how much detail is the right level of detail? Others may suggest this is too radical a change in a mature, understood and tested set of systems. IBM experience with some of the largest financial services companies suggests that building a finance system. based on the requirement to instrument the most granular level of transaction detail immediately stems the tide of increasing costs, lowers a variety of risks and can be a key driver of transformation of the banks ability to become more agile. In time this approach begins to provide economies of scale for reporting.

SAFR is: (1) an information and reporting systems theory, (2) refined by 25 years of practical experience in creating solutions for a select group of the world’s largest businesses, (3) distilled into a distinctive method to unlock the information captured in business events, (4) through the use of powerful, scalable software for the largest organization’s needs, (5) in a configurable solution addressing today’s transparency demands.

The Theory

Companies expend huge sums of money to capture business events in information systems. Business events are the stuff of all reporting processes. Yet executives report feeling like they are floating in rafts, crying “Data, data everywhere and no useful information.” Focusing reporting systems on exposing business events combinations can turn data into information.

The Experience

Although analysis of business events holds the answers to business questions, they aren’t to be trifled with, particularly for the largest organizations. Reporting processes—particularly financial reporting processes—accumulate millions and billions of business events. In fact, the balance sheet is an accumulation of all the financial business events from the beginning of the company! Such volumes mean unlocking the information embedded in business events requires fundamentally different approaches. The 25 years of experience of building SAFR in services engagements has exposed, principle by principle, piece by piece, and layer by layer the only viable way.

The Method

This experience has been captured in a method of finding and exposing business events, within the context of the existing critical reporting processes. It uses today’s recognized financial data like a compass pointing north to constrain, inform, and guide identification of additional reporting details. It facilitates definition of the most important questions to be answered, and to configuring repositories to provide those answers consistently. It also explains how to gradually turn on the system without endangering existing critical reporting processes.

The Software

The infrastructure software, a hard asset with hundreds of thousands of lines of source code and feature set rivaling some of the best known commercial software packages, is most often what is thought of when someone refers to SAFR.

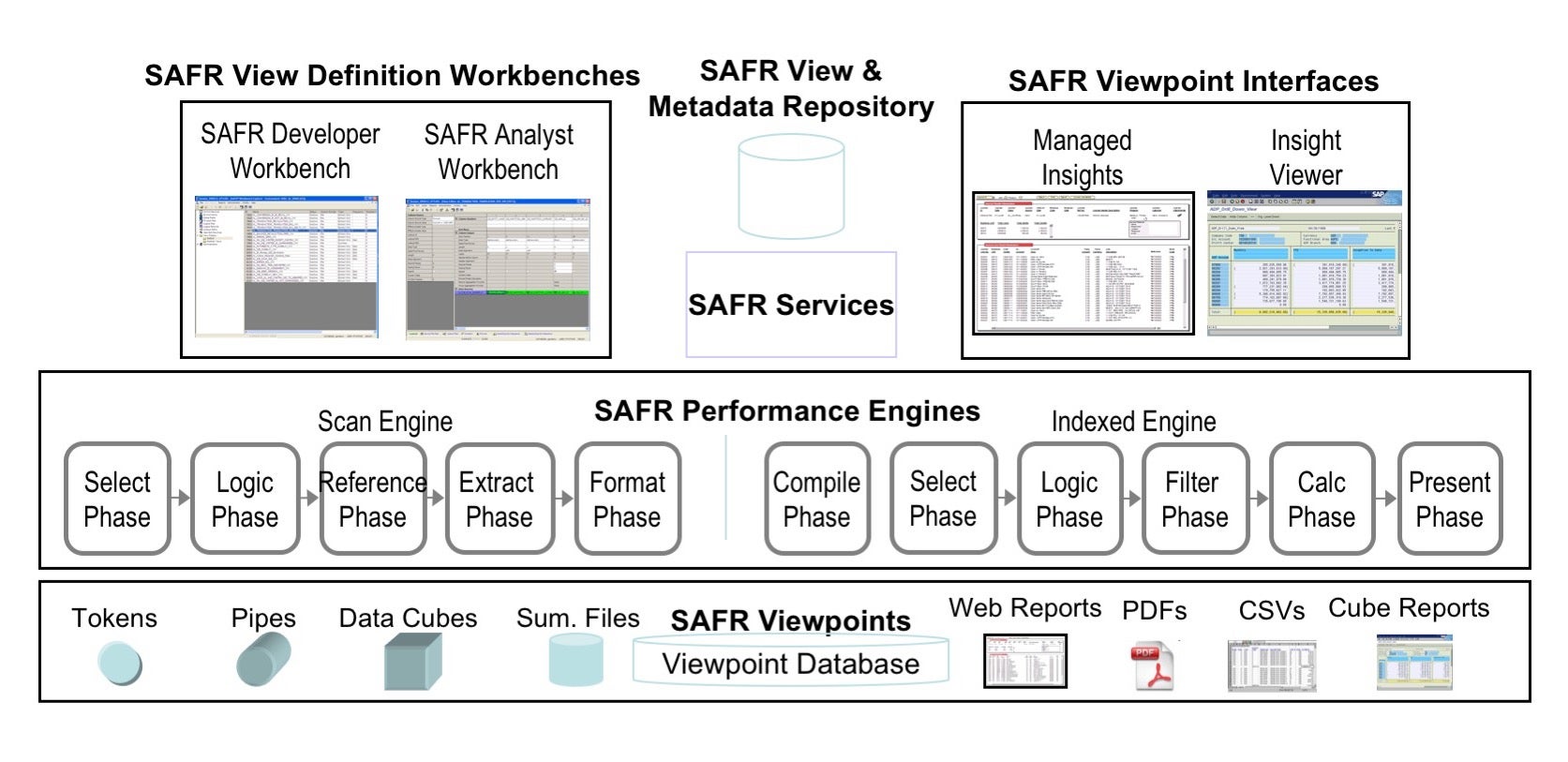

The Scan Engine is the heart of SAFR, performing in minutes what other tools require hours and days to do. The Scan Engine is a parallel processing engine, generating IBM z/OS machine code. In one pass through a business event repository it creates many business event “views,” providing rich understanding. It categorizes, through join processes, the business events orders of magnitude more efficiently than other tools. Built for business event analysis, it consistently achieves a throughput of a million records a minute. It is highly extensible to complex problems.

SAFR Views are defined in the SAFR Developer Workbench or rule based processes in the SAFR Analyst Workbench or in custom developed applications. The Scan Engine executed as a scheduled process, scans the SAFR View and Metadata Repository selecting views to be resolved at that time.

The Indexed Engine, a new SAFR component, provides one at a time View resolution through on-line access to Scan Engine and other outputs. It uses Scan Engine performance techniques. Reports structure and layout are dynamically defined in the Analyst Workbench. The Indexed Engine creates reports in a fraction of the time required for other tools. Its unique capabilities allow for a movement based data store, dramatically reducing data volumes required both in processing and to fulfill report request.

Upon entering Managed Insights, users select parameters to drill down to increasing levels of business events, and perform multidimensional analysis through the Viewpoint Interfaces. The Insight Viewer enables discovery of business event meaning in an iterative development mode.

The Solution

The SAFR Infrastructure Software has been configured over 10 years for number of clients to provide an incredibly scalable Financial Management Solution (FMS) for the largest financial services organizations.

The heart of FMS is the Arrangement Ledger (AL). An “arrangement” is a specific customer/contract relationship. The AL, a customer/contract sub-ledger, maintains millions of individual customer/contract level balance sheet and income statements. This incredibly rich operational reporting system supports a nearly unbelievable swath of information provided by scores of legacy reporting systems in summary, with the added benefit of being able to drill down to business event details if needed. Doing so allows reporting high quality financial numbers by customer, product, risk, counterparty and other characteristics, all reconciled, audited, and controlled.

AL is fed daily business events typically beginning with legacy general ledger entries and then transitioning to detailed product systems feeds over time. The business events become complete journal entries at the customer-contract level, including reflecting the impact of time in the Accounting Rules Engine. Rules are under control of finance rather than embedded in programs in source systems, enabling Finance to react to changes in financial reporting standards, including International Financial Reporting Standards (IFRS).

The business event journal entries are posted by the Arrangement Ledger on a daily basis, while it simultaneously generates additional point in time journal entries based upon existing balances, including those for multi-currency intercompany eliminations, GAAP reclassification and year-end close processing. It accepts and properly posts back-dated entries to avoid stranded balances, and summarizes daily activity to pass to the General Ledger. The General Ledger provides another control point for the traditional accounting view of the data. The Arrangement Ledger detects and performs reclassification keeping the arrangement detail aligned with the summary General Ledger

AL also accepts arrangement descriptive information with hundreds of additional attributes to describe each customer-contract, and counterparty or collateral descriptive attributes, enabling producing trial balances by a nearly unlimited set of attributes, not just the traditional accounting code block. Extract processes produces various summaries, perhaps ultimately numbering in the hundreds or thousands, to support information delivery for not only traditional accounting but also statutory, regulatory, management, and risk reporting. The SAFR one pass multiple view capability allows AL to load data, generate new business events, and create extracts all in one process, including loading the incredibly information rich Financial Data Store.

Information Delivery includes multiple ways of accessing the Arrangement Ledger and Financial Data Store. The major window is through SAFR Managed Insights. This parameter-driven Java application provides thousands of different permutations of the data. It allows drill-down from summaries to lower and lower levels of data without impacting on-line response time. It allows dynamic creation of new reports and multi-dimensional analysis of Financial Data Store data. Extract facilities provide the ability to feed other applications with rules maintained by finance. Other reports provide automated reconciliation and audit trails.

FMS can be tailored to work within an existing environment, including working within the existing security and reference data frameworks. FMS is often can be a sub-component of an ERP implementation.

Conclusion

This is a financial system architecture for the 21st century. This is the reporting system architecture for the 21st century. Finance transformation starts with finance systems transformation. Finance systems transformation starts with rejecting the legacy finance systems architecture that provides only summary results. It is transforming the financial systems—the original enterprise data warehouse—into a system capable of supporting today’s information demands.

__________

Copyright ©2010, 2011, 2015, 2018 by Kip M. Twitchell.

All rights reserved. No part of this book may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without permission in writing from the author except for the use of brief quotations in a book review or scholarly journal. Posted by permission.